That blue envelope from BC Assessment is not a bill, yet it dictates your financial landscape for the next twelve months. Every January, property owners across Greater Victoria scramble to decode the numbers printed on those notices. Confusion is the default setting. Most people glance at the total, compare it to their neighbor’s, and either shrug in relief or fume in silence. Statistics show that less than 2% of British Columbians actually formalize a dispute. That is a staggering gap in engagement. Understanding why your assessment looks the way it does is the first step in mastering your local real estate position. I invite you to consider this article as a useful property assessment guide for 2026 in Greater Victoria.

The Algorithm Versus The Street

BC Assessment uses a mass appraisal system. They aren’t walking through your front door to admire your new quartz countertops or the custom millwork in the den. They are looking at July 1st of the previous year. It is a rearview mirror approach. Market value is what a buyer will pay today; assessed value is a government snapshot of what happened months ago. This lag creates a disconnect.

When you work with a REALTOR®, you are looking at live data. We see the bidding wars happening this morning. We see the inspections that fell through. BC Assessment sees the data points. They use variables like size, age, location, and recent sales of “comparable” properties. But a computer doesn’t know that the house two doors down has a persistent drainage issue or that your specific street has significantly more noise than the next block over.

A Decade Of Growth: The Hard Numbers

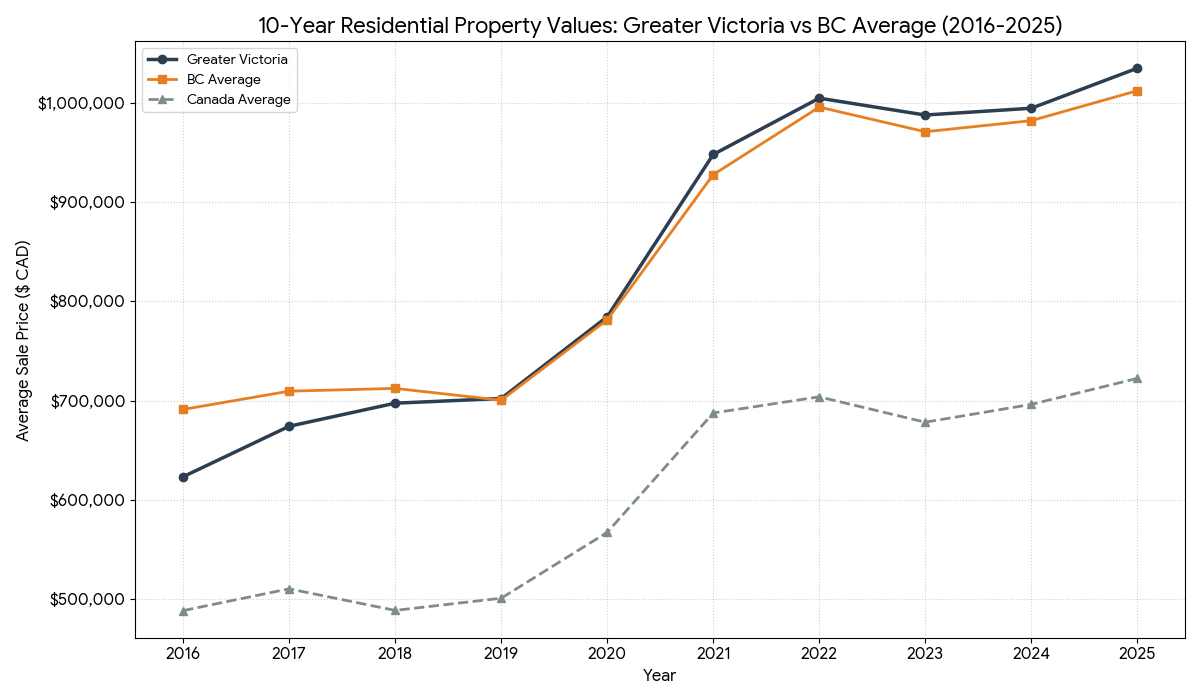

The trajectory of property values in Victoria has been nothing short of aggressive. To understand where we are, we must look at the climb. The following data outlines the average residential assessment shifts over the last decade, contrasting Greater Victoria against provincial and national trends.

Verified Residential Property Values (2015–2024)

The following data reflects the Annual Average MLS Sale Price for all residential property types (including single-family homes, condos, and townhomes). 10-Year Residential Assessment Value Trends (Estimated Averages in CAD).

10-Year Residential Assessment Value Trends (2016-2025)

| Year | Greater Victoria (Average) | BC Provincial Average | Canada Average |

| 2016 | $623,200 | $691,100 | $488,203 |

| 2017 | $674,100 | $709,500 | $510,179 |

| 2018 | $697,400 | $712,300 | $488,400 |

| 2019 | $702,100 | $700,400 | $500,690 |

| 2020 | $784,500 | $781,500 | $567,100 |

| 2021 | $948,200 | $927,877 | $687,500 |

| 2022 | $1,005,000 | $996,000 | $703,800 |

| 2023 | $988,000 | $971,152 | $678,200 |

| 2024 | $994,848 | $ 982,326 | $ 696,179 |

| 2025 | $1,035,200 | $1,012,500 | $722,400 |

Data Note: Figures represent generalized residential averages derived from BC Assessment and CREA historical data. Localized fluctuations in Victoria neighborhoods like Oak Bay or Langford often exceed these averages.

Key Observations:

- The “Crossover” Point: In 2019, Greater Victoria’s average residential price officially overtook the BC provincial average. This is because Victoria’s market remained resilient while the Vancouver-area market (which heavily skews the provincial average) experienced a temporary cooling period following the introduction of the Speculation and Vacancy Tax.

- Single-Family Homes vs. All Residential: If you look specifically at single-family detached homes, Greater Victoria is significantly higher than the provincial average. In 2024, the average single-family home in Greater Victoria sold for approximately $\$1.29$ million, whereas the provincial average for single-family homes is lower when you factor in more affordable regions like the Interior and Northern BC.

- Assessment Values: BC Assessment data for 2024/2025 also confirms this, with “typical” single-family home assessments in core Victoria and Saanich sitting between $$1.14M and $$1.16M, well above the typical values found in most BC municipalities outside of the Lower Mainland.

Visualizing The Surge

I graph this data where you can see three distinct lines. The Canada line shows a steady, moderate incline with a notable peak in 2022. The British Columbia line sits consistently higher, reflecting our status as one of the most expensive jurisdictions in North America. The Greater Victoria line, however, shows a unique “hockey stick” curve starting around 2016.

While the national market fluctuated with interest rate hikes, Victoria’s limited inventory kept the floor from dropping. We are an island. Land is finite. Demand is global. This reality is baked into your assessment, even if your specific house hasn’t changed a bit in twenty years.

ASSESSMENT ESSENTIALS

- The July 1st Rule: Your assessment reflects the market value as of July 1st of the previous year, plus the physical condition as of October 31st.

- The 1% Club: Only about 1% to 2% of property owners in BC actually appeal their assessments annually. Most people accept the number without question.

- Assessment ≠ Tax Bill: A 10% increase in your assessment does not mean a 10% increase in taxes. It is your value relative to the average change in your municipality that matters.

- The REALTOR® Advantage: A REALTOR® provides “Current Market Value,” which is the only number that matters if you are actually buying or selling today.

- The Dispute Window: You typically only have until January 31st to file a formal Notice of Complaint (Appeal).

Why Most People Stay Silent

Perplexity research indicates that a massive percentage of homeowners in Greater Victoria do not understand the dispute process or feel it is “low stakes.” This is a mistake. While a lower assessment might bruise your ego, it can lower your property tax burden. Conversely, if you are planning to sell, an inaccurately low assessment can sometimes (though not always) create a psychological “low ceiling” for potential buyers who rely on online data.

Many owners fear that if they dispute an assessment, they will trigger a manual inspection that finds “too much” value. This is largely a myth. The Property Assessment Review Panel (PARP) is there to ensure equity. If your home is assessed at $1.2M but three identical houses on your street sold for $1.1M in June, you have a case. Evidence is the only currency they accept.

The Victoria Context: Neighborhood Variance

In Victoria, the Victoria Real Estate Board (VREB) data frequently shows that the “Core” (Victoria, Saanich, Esquimalt, Oak Bay, and View Royal) behaves differently than the Westshore or the Peninsula. BC Assessment tries to group these, but the nuances are massive.

An assessment in Fernwood might rise because of “character” appeal and proximity to downtown, while an assessment in Langford might rise due to new infrastructure and commercial development. As a REALTOR®, I look at the micro-markets. Your assessment is a macro-tool. When the two diverge, that is where the opportunity—or the risk—lies.

The Tax Impact Fallacy

The most common fear is that a skyrocketing assessment equals a skyrocketing tax bill. This is not how municipal math works. Municipalities determine their budget first. Then they spread that cost across the total assessed value of the city.

If the average assessment in Victoria goes up 10%, and your property also goes up 10%, your taxes will likely stay stable (excluding budget increases). You only see a significant tax jump if your property’s value increases at a rate higher than the municipal average. If your assessment went up 20% while everyone else went up 5%, your wallet will feel it. This is the primary reason to scrutinize your notice.

Challenging The System

If you decide to dispute, do not go in armed with “feelings.” Go in with a REALTOR®. We provide the comparative market analysis that shows actual closed sales. These are the “comparables” that BC Assessment may have missed or miscalculated.

Check your property details. Does the assessment say you have a finished basement when it’s actually a crawlspace? Does it list four bedrooms when one is an office without a closet? These technical errors are common and are the easiest way to adjust your valuation. The system is run by humans and algorithms; both are fallible.

Strategy Over Stress

Property assessments are a tool, not a verdict. They provide a baseline for the province to function, but they rarely capture the soul of a home or the immediate heat of the Victoria market. You need to know your number. You need to know if it’s fair. But you should never mistake it for the price you can get on the open market today.

The market is moving. Interest rates are shifting. The inventory in Greater Victoria remains the primary driver of value. If your assessment arrived and left you with more questions than answers, it is time to look at the data that isn’t eighteen months old. Real estate wealth is built on information. Ensure yours is accurate.

Stop guessing about your equity. Reach out to me as a professional REALTOR® to get a real-time valuation of your home. The government has their say every January, but the market has its say every single day. Make sure you’re listening to the right one.